mai 18, 2022

WHAT TO DO ABOUT RISING INTEREST RATES?

Rising Interest Rates… Business Considerations?

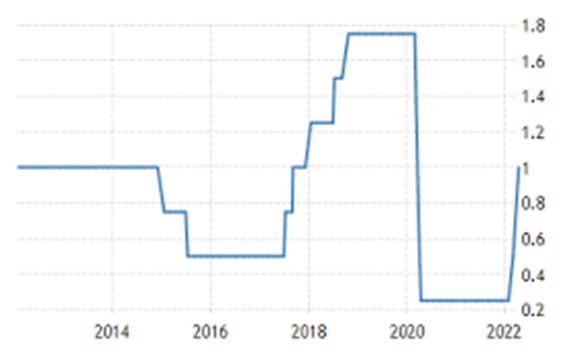

Canada’s pandemic-era period of historically ultra-low interest rates is over. With the Bank of Canada considering a half-point interest rate hike in June, Canadian business owners are asking themselves what they should do to get ready.

With inflation running at a three-decade high of 6.7%, well above the Bank of Canada’s target range of 1-3%, the bond market in late April was fully pricing in a 50-basis-point (bps) hike in June and predicting a 30% chance of a 75-bps hike. The Bank of Canada has already raised its overnight interest rate by 50 bps to 1% on April 13, the first time it raised rates that much since 2000. This is an opportunity for business owners to re-evaluate the benefits of cost certainty versus playing the market with a floating rate.

Businesses switching to fixed-rate loans

Some Canadian bond yields have already surpassed pre-pandemic highs, with the average interest rate on 10-year Canadian government bonds hitting 2.8% in late April, up from a low of 0.79% in Aug. 2020. It would be reasonable to expect rates would rise an additional 50 to 100 points, if not more, unless there is an additional shock to the economy. People in the past two years were opting for floating rates, but the pendulum is definitely swinging back to the fixed side.

Opportunity to lock in cost certainty

Market experts recommend considering a fixed rate to lock in interest payments, especially for capital-intensive businesses, those with low margins, or companies making a large investment, or a business acquisition. A small change in interest rates is very important for many companies. This is an opportunity for business owners to re-evaluate the benefits of cost certainty versus playing the market with a floating rate. With a floating rate, the interest rate is an uncontrollable factor, but you can make it controllable by locking it in.

For many business owners, that cost certainty outweighs the current premium for fixed-rate loans over the floating-rate option. By locking in your rate, you can remove risk from financing costs and focus on risks in other areas of the business.

Interest rates still historically low

Businesses should consider proceeding with investments sooner rather than later as high inflation means projects are bound to cost more if they’re delayed. Now is the time to act, provided it makes sense for your business. It is not going to get easier than now. Interest rates are historically still very low, and the cost of any project will be higher in a year or two because of inflation. If you don’t invest, you could be left behind because the competition will be investing.

Update budgets, projections to reflect higher rates

It is also recommended that businesses review their budgeting, financial projections, and funding application to update them to reflect higher projected rates. Budgets absolutely have to assume higher interest rates for longer-term borrowing and more expensive lines of credit. It is always best to be conservative.

Businesses should build in various scenarios into their budgets and projections to consider the impacts of different levels of rate hikes over the next 12 to 24 months. It’s common to see a lack of scenario planning among many companies. Scenario planning is an important way for businesses to see how they’re performing, identify favourable and unfavourable areas, and mitigate future uncertainty and risks.

How to get a lower interest rate on a business loan

The interest rate on a loan reflects a bank’s assessment of the risk that you won’t repay the money. To compensate for its risk, the bank decides how much interest to charge you over the rate it gives to its best, most creditworthy customers. To reduce your rate, you must persuade your banker you will repay the money on time and in full.

There are four ways to improve your chances of getting a better rate for your business:

- Improve your company’s profitability

- Raise your credit score

- Offer valuable collateral to secure the loan

Build a relationship with your bank